Economy 707 maintains that prices rise with demand. The logic is that when the market wants more of something, competition pushes up the price. But sometimes, there is a price anomaly, and prices behave differently. Enter lab-grown, for instance.

When consumer demand for lab grown (LG) was relatively low, there was a frenzy to join the supply chain. Everyone from producers to retailers wanted in. So far, the result of this frenzy is the LGD Price Anomaly: rising consumer demand and declining wholesale prices.

The Pipeline Vise

This price decline is not completely surprising. The LG supply chain is crowded in all directions. The number of LG-producing factories is growing, and all of them are pushing to increase their production output.

Currently, producers are happy because they are seeing fierce competition for their product: rough lab grown goods. Demand for rough LG is high, and rough prices are firm.

At the other end of the supply pipeline, the number of retailers offering LG-set jewelry has increased almost exponentially in the past few years. Retailers are more than happy to offer their clients an up-and coming product, leading to a rise in demand from this sector.

Over time, most retailers have become far more knowledgeable about LG and increasingly specific about their purchases. Some want only non-treated CVDs. Many are refusing LG with color tints. Others prefer HPHT-made LG because it costs less.

Most importantly, retailers are firmer on their buying costs, and many insist on getting goods on memo. Wholesalers have almost no choice but to oblige.

However, the firmness on both ends of the LG pipeline, producers on one end and retailers on the other, is pressing wholesalers in between.

The Making of a Price Anomaly

The wholesale section of the LG market is congested. Traders who found the natural market tough swarmed into LG only to run into the same issues they tried to escape from.

And now, they are finding out the hard way that the LG market is different than the natural diamond market. Despite the obvious overlap, this market requires specialization because the differences are clearly there: different pricing dynamics, inventory issues, marketing, and even acceptability.

The result is that a massive number of traders, mainly in India, are stuck with large inventories and a desire, if not a need, to leave the LG market behind.

Their exodus includes off-loading goods, further pushing down prices. So while rough LG supply is not easy to come by and retailer demand is growing – normally, the makings of a price surge – it is instead resulting in a price decline -very much a price anomaly!

LG Price Trends in Q3

To be clear, not all goods in all categories are declining. Broadly, prices of smaller goods, half-carats and below, inched up in the third quarter. The average rise is a little more than 7%, according to our diamond market analytics.

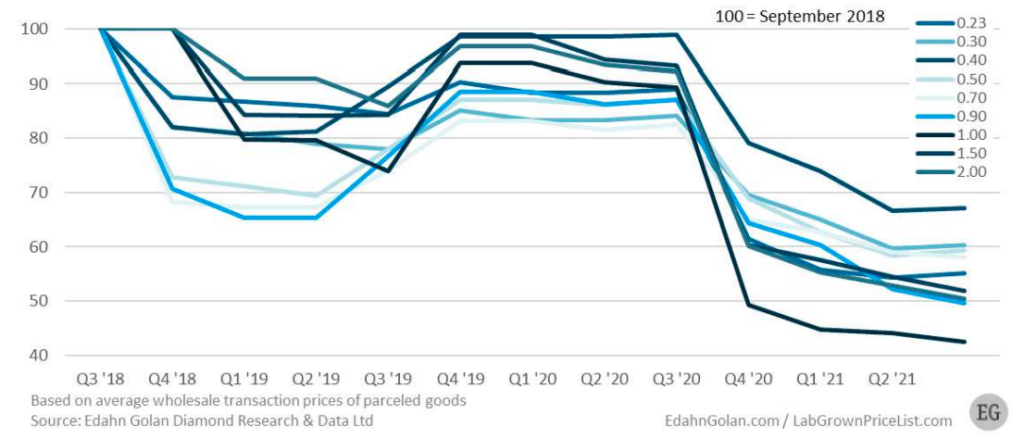

Larger goods, 0.70 carats and up, continued to decline, down 3-4% during the period, as the LG diamond price chart shows below.

A Crowded Market Keeps Impacting

Lab-Grown Prices Lab-Grown Wholesale Transaction Prices

Lab- Grown Diamond Price Index Slides

Compared to the second quarter, the Lab-Grown Diamond Price Index declined 3.7%. This is a moderate decline compared to the mid-single digit declines seen in the first and second quarters of the year.

On a year-over-year basis, the LG diamond index dropped a massive 42.7%.

If price declines continue to moderate, or if prices even rise as the holiday season rolls in, expect to see these immense year-over-year changes shrink dramatically.

An Ongoing Downward Price Trajectory

LG Diamond Price Index Q3 2018-Q3 2021

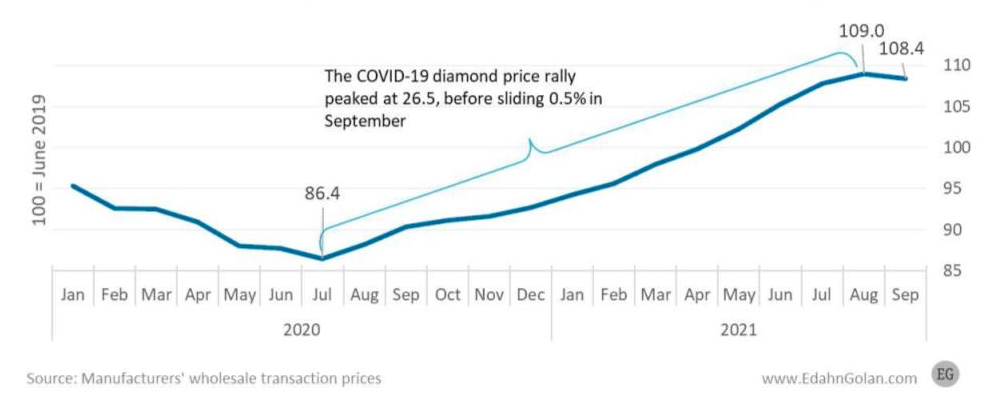

Diamond Price Rally Ends – For Now

The wild rally natural diamond prices had enjoyed since August 2020 largely ended in September. Wholesale transaction prices softened for the first time in just over a year, down 0.5% according to the transaction diamond price index.

But while diamond prices declined in September, don’t expect a price tumble just yet. As the holiday season approaches, expect prices to rise again, especially in December.

Wholesale Diamond Prices Increased for a Year, and Declined

Wholesale Round Polished Diamond Transaction Price Index

A 60% Price Gap

As all the above indicates, the price gap between natural diamonds and LG remains a large one. According to Tenoris, which analyzes monthly retail activity data from some 950 US jewelry stores, the retail price gap was a high double digit.

The average retail price of round, one-carat, E/Sll diamonds was $8,900 per carat in September, according to a Tenaris analysis. This compared with $3,557 for LG – a 60% difference.

The cost difference was even larger. Natural diamonds sold in September cost retailers on average $5,475 per carat. LG sold last month, cost them just $7,349 p/c. This is a massive 75% difference.

Two of the conclusions that can be drawn by these figures are that retailers are fighting to reduce their LG costs, but they are not quick to reduce their consumer prices. Second, retailers are doing whatever they can to increase margins.

While retailers’ natural diamond margins are typically around 40-45% (in this example 38%), for LG, they are much higher, around 60% (in this example, 62%).

The Bottom Line

The holiday season will give natural diamonds another upward push, and holiday demand will dictate the price direction afterwards.

Just as competition pushed down LG prices in the wholesale market, this will follow in the retail market. A gross of 60% is something consumers won’t be willing to accept for long.

This decline won’t happen overnight or soon, but it is inevitable.

While a price anomaly happens every so often, it is never a long-term economic trend.