Lab-grown diamonds are a living contradiction. Demand is rising, but prices are falling. They are hot in the US, but not sweeping the rest of the world. Wholesalers accommodate price erosion. It’s a technological driven product catering to a young crowd and striving to follow in the footsteps of a centuries-old product, while enthusiastically adopting many of its ills.

The Lab-Grown Diamond Contradiction: Position

The most surprising contradiction in the lab-grown diamond sector has to do with its most basic positioning. While bashing the old guard in the name of disruption, it’s clinging to natural diamonds for dear life.

At its core, the fundamental value of mother-nature’s made diamonds is that they are natural – ancient creations that will keep shining forever. That is the source of their symbolic value.

For lab-grown to insist that “we are the same, but lab made,” is a marketing oxymoron.

The appeal of natural diamonds is strengthened by their being a luxury item. By definition, this means pricey. However, the lab-grown diamond message tops “not natural” with “low cost”.

This is a very contradictory marketing message. And one that won’t last.

Simply stated, lab-grown diamonds need their own story- a fresh, genuine, unique, and independent story. Most importantly, one that is free from a negative undertone, A tale that fits the times, the audience, and the product.

Without it, we are witnessing a massive disaster in slow motion. And it is one that can be avoided.

It’s not my goal to bash the lab-grown diamond sector. On the contrary, it has the makings of a successful opportunity. It just needs to rid itself of the harmful contradictions by shaking off the attachment to the same allure as natural diamonds and start to talk about its own values.

With that in mind, following are some figures and findings from the current market that support this view.

The Lab-Grown Diamond Contradiction in Pricing

Polished lab-grown diamond prices are falling continuously. And this is not solely at wholesale. Across the board, from lab-grown rough diamond prices to retail prices, the movement is south.

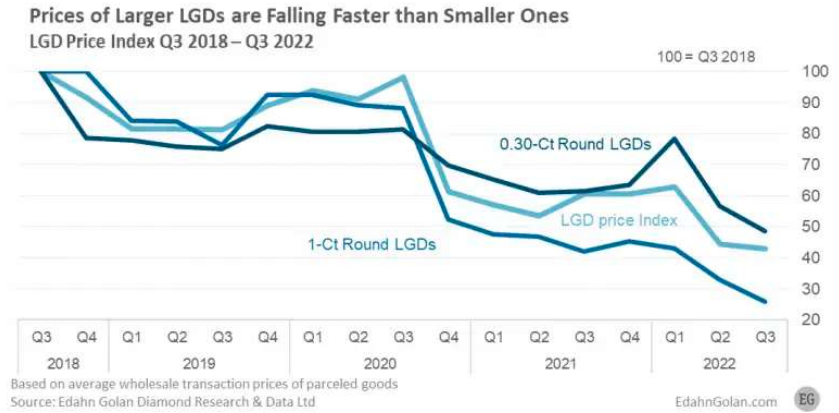

Wholesale lab-grown polished diamond prices declined 6-37% in the third quarter of the year. The rate of decline was tied directly to size, as well as to color/clarity combinations.

Prices of larger goods fell sharply in the wholesale diamond market. One-carat rounds declined 27.8%. Prices of two-carat goods dropped nearly 33%. This is a significant plunge.

A number of factors contributed to this large decline. One factor has to do with the improved technologies in producing lab-grown diamonds. It is easier now to produce larger rough, making them more prevalent.

With the greater availability, large polished lab-grown diamonds are following the same cost and price trajectory that smaller goods did in the past: as rarity declines, there is growing pressure to lower price.

With consumers now more willing to buy larger lab-grown – sales of two-carat stones doubled in Q3 2022

– following is a pressure to adjust prices downwards. As bigger goods become available, they are initially priced relatively high. But, over time, they become more prevalent, and their prices decline.

The reason for this has to do with one of the two fundamental tenets of lab-grown positioning: they are cheaper. It follows that consumer expectation is that prices will be low, and window shopping will become a search for the most reduced prices.

Retailers are sensitive to consumer price demand and react to it. That is where the pressure comes from.

Naturally, greater availability, lower cost of production, and inventory pressures play a role too. But I’ve yet to meet a diamond seller happily reducing asking prices without the buyer asking for it. Well, unless they are desperate for cash flow…

Smaller Goods Are More Price Resilient

During the third quarter, the price decline in smaller-size goods was much less noticeable, especially for half-carats and smaller. Some were in the lower single digits.

The mild decline for smaller goods follows deeper declines that already took place in the past – in late 2018 and late 2020.

Another element that is possibly supporting prices of smaller goods is a shortage in small natural diamonds. This is a result of US sanctions on ALROSA, the main supplier of these diamonds.

A Widening Diamond Price Gap

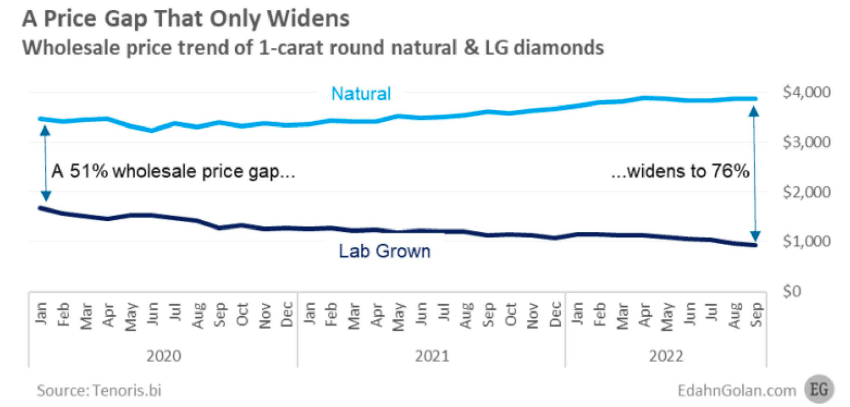

After a period of rising natural diamond prices, their prices are also now declining. While it is a far more moderate decline than those of the lab-grown, it is still clearly there.

Despite this recent decline, the natural/lab-grown diamond price gap is expanding.

In January 2020, the average difference in cost US retailers paid for one-carat diamonds was 57%. Last month, that cost gap was 76%.

In less than two years, the wholesale cost gap increased almost 50%. This contradictory pricing direction tells a tall story of the erosion in lab-grown diamond value and the current diamond market.

I’m intentionally comparing retailers’ costs, and not their selling prices, because they are far more homogeneous across the board. This eliminates variations caused by the retail markups associated with positioning and provides you with a sounder understanding of genuine changes.

The Lab-Grown Contradiction in Margins

Other than consumer demand, the only place in the lab-grown diamond market with a rise is in retailer margins. That is another odd contradiction in lab grown.

While retailers are lowering retail prices, it is not at the same rate as their decline in costs. Retailers, famous for their ability to protect margins at all costs, have succeeded in increasing their gross margins over the yea rs.

They achieved this by pressuring their vendors to reduce prices, while not being as fast to pass on the benefits to consumers.

In 2020, specialty jewelers’ average gross margin on lab-grown diamond sales was 48.9%. A year later, it rose to 50.1%. In 2022 to date, specialty jewelers’ average gross margin was 52%, up 4.2% year over year. That is the lab-grown diamond sector trend, according to our own diamond market analytics.

Lab-Grown Diamond Memo Supply Unreasonable

Providing goods on memo used to be a typical way to capture market share. When the diamond industry secured generous financing, it was also inexpensive to do, and profitable if you charged a handsome premium for the delayed payment.

However, with a decline in financing and the rise in its cost, the practice makes less sense. Natural diamonds are provided on memo to a considerably lesser degree.

But the lab-grown diamond contradiction is at play here too. Memo terms were provided for more than 40% of the goods supplied to retailers, and this is only growing. Today, it’s already nearing 50%. Seriously? In a market with constant price declines?

Lab-Grown Diamond Hough Declining Too

Lately, lab-grown rough diamond prices have been falling as well. The primary driver is not a lack of demand or a decrease in the cost of production. It is the result of the action of one large grower.

Just as wholesalers make their way into a store by lowering prices and undercutting the competition, it seems that some lab-grown growers are doing the same to appeal to manufacturers.

A few months ago, one of the lab-grown producers lowered rough prices significantly. It forced other producers to reduce prices, dragging down rough lab-grown prices for the entire market.

It’s unknown if this was done to capture market share or if the producer was in an urgent need for cash flow.

Whatever the reason, the impact on prices coupled with lab-grown diamond market dynamics, leads me to believe that rough lab-grown diamond prices won’t be restored.

If you expect this move to further drag down polished prices, you’re not mistaken.

The Bottom Line

The two most pressing issues the international lab-grown diamond market is facing are poor positioning and value erosion.

Without a story of its own, lab-grown diamonds will forever be hanging off natural diamonds – a product lab-grown proponents are constantly bashing. This is the largest lab-grown diamond contradiction.

The second is the constant decline in prices. With exceptionally generous margins, wholesalers are relatively flexible, but from an inventory management perspective, this is not good. The value of the goods in inventory is suffering from an erosion.

As one astute buyer recently said, inventory value loss is a trader’s most daunting challenge. A rise in lab grown diamond supply will only exacerbate the situation.

Are you interested in detailed lab-grown diamond analytics? Would this data be invaluable in your decision making? We can answer these and many other questions related to the diamond and jewelry economy.